You can now use EezyPay without extra fees. You will only pay Eezy’s regular service fee which will be charged at the time of salary payment.

If you’re already an Eezy light entrepreneur, you’ll find EezyPay in our online service and mobile app.

1. Create a payment page on the online service by filling in the job-related information.

2. Share the payment page with your customer using a QR code or link. By copying the link, you can send it to your customer via text message, WhatsApp, email, add it to your website, or social media account. You can send the same payment link to multiple customers.

3. Your customer selects a suitable payment method and pays. EezyPay allows for payment in advance or immediately after the service is delivered.

4. You will receive your salary faster, at the latest on the next bank day after your customer has made the payment.

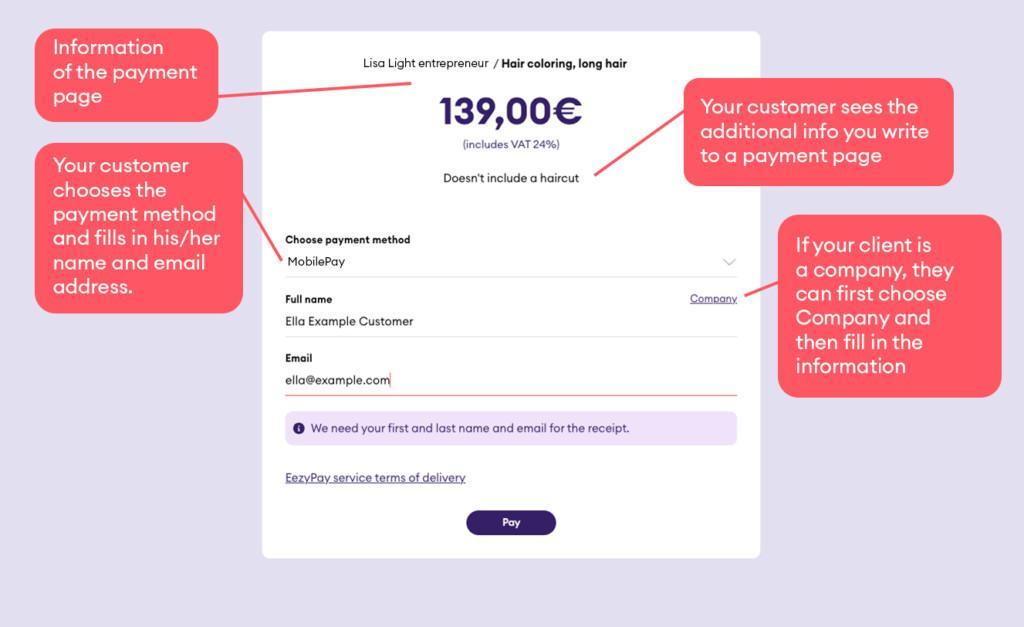

What does EezyPay look like to the customer in practice? The customer’s view of EezyPay is very simple. It shows:

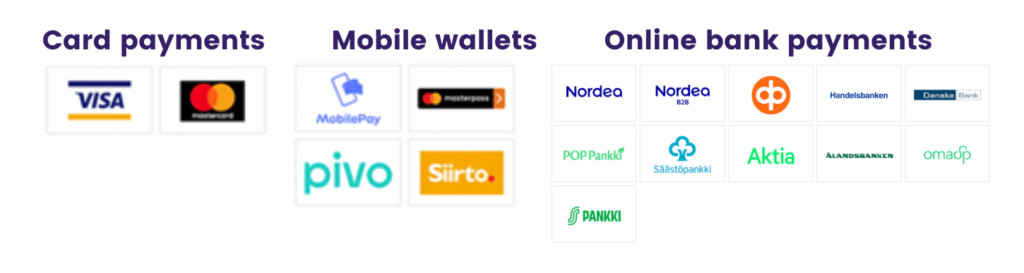

The customer fills in their contact information themselves, so you no longer need to inquire about invoicing details. EezyPay enables convenient payment options for the customer, such as MobilePay and card or online payment.

At this point, you might be wondering how EezyPay differs from traditional invoicing and whether it’s worth the cost. It’s important not to forget that the value of EezyPay also lies in the time it saves for the light entrepreneur, as separate invoices no longer need to be typed out. Offering flexible payment options and easier payment processing enhances the overall experience for your customers. We’ve compiled a clear table outlining the differences between EezyPay and traditional invoicing. Also, read Riikka’s experiences on how EezyPay simplifies invoicing for light entrepreneurs!

| EezyPay | Traditional invoice | |

|---|---|---|

| Asking customer to pay | With payment link or QR code | With invoice |

| Asking the payment information | The customer fills in the information (name and email address) | You have to ask the information from the customer (name, email address and invoicing address) |

| Available payment methods | For example MobilePay, Pivo, Siirto, credit card, online payment | Paying invoice on the online bank |

| The payment term | In advance or immediately after the service is delivered, so you will receive your salary faster | Payment term for consumer customers: 14 days |

| Versatility | You can share the same payment link to multiple customers | You have to create own invoice to every customer |

| Workload | Creating a payment page: 1-3 minutes | Creating an invoice: 5-30 minutes |

| What kind of payments does it apply to | Primarily for consumer customers, but can also be suitable for business customers: no official invoice is issued for the work, but the customer receives an official receipt for the payment for accounting purposes. | For consumer or business customers, with the option for business customers to receive e-invoices |

You can now use EezyPay without extra fees. You will only pay Eezy’s regular service fee which will be charged at the time of salary payment.

If you’re already an Eezy light entrepreneur, you’ll find EezyPay in our online service and mobile app.